Best REIT Brokers: Comprehensive Guide to Real Estate Investment Trust Trading

Real Estate Investment Trusts (REITs) have emerged as one of the most accessible ways for individuals to invest in real estate without directly owning property. By pooling investor funds to purchase and manage income-producing real estate assets, REITs offer consistent dividends and long-term appreciation potential. However, to access these opportunities efficiently, investors need reliable brokers who specialize in REIT trading.

The best REIT brokers not only provide access to diverse REIT products but also enhance the investor’s journey through research tools, low-cost transactions, and seamless trading platforms. Choosing the right broker is essential because it influences the profitability, accessibility, and overall efficiency of REIT investments.

Understanding the Role of REIT Brokers

REIT brokers act as intermediaries between investors and the markets where REITs are traded. They provide the platforms, tools, and services necessary to buy and sell REIT shares, whether listed on public exchanges or offered as private placements.

A reliable REIT broker goes beyond execution; they offer research reports, portfolio management features, and educational resources. This makes it easier for both beginners and experienced investors to understand market trends, assess risks, and make informed investment decisions.

By combining access to REIT markets with advanced technology, these brokers simplify the complex world of real estate investing.

Why Choosing the Best REIT Brokers Matters

The quality of the broker you choose directly impacts your investment experience. A poorly designed platform with high fees can reduce your returns, while a sophisticated, transparent broker can maximize profitability and provide long-term stability.

Additionally, brokers differ in the REIT products they offer. Some focus on publicly traded REITs listed on major exchanges, while others provide access to non-traded or private REITs, often requiring more expertise to evaluate.

Ultimately, the best REIT brokers align with an investor’s goals, whether that means regular dividend income, exposure to specific real estate sectors, or long-term capital growth.

Key Features of the Best REIT Brokers

Accessibility and Ease of Use

Top REIT brokers offer user-friendly platforms that make it easy to research, trade, and manage investments. Investors should be able to access their portfolios via desktop or mobile devices, ensuring flexibility and convenience.

A smooth user interface helps investors stay engaged, make quick decisions, and avoid mistakes during market volatility.

Research and Analysis Tools

The best brokers provide advanced market research, analyst ratings, and portfolio insights. Since REITs are closely tied to real estate market cycles, access to high-quality data is critical for timing investments effectively.

Comprehensive research tools empower investors to understand asset performance, dividend histories, and sector-specific risks before committing their funds.

Low-Cost Transactions

Transaction fees can erode returns over time, particularly for income-focused REIT investors. The best brokers minimize these costs through commission-free trading or reduced fees, ensuring that dividends and capital gains are not significantly impacted.

Security and Reliability

Trust is crucial in financial markets. The best REIT brokers are regulated by trusted authorities and offer secure platforms to protect investors’ funds and personal information.

Real-World Examples of the Best REIT Brokers

Charles Schwab

Charles Schwab is a leading broker known for its robust trading tools and wide access to publicly traded REITs. Investors benefit from commission-free stock and ETF trading, extensive research reports, and retirement-focused planning tools.

For REIT investors, Schwab offers analyst insights, dividend reinvestment options, and sector-specific research, making it an excellent choice for those seeking both growth and income. Schwab’s transparency and reputation for reliability make it one of the best brokers for long-term REIT investing.

Fidelity

Fidelity stands out for its strong emphasis on research and education. It provides in-depth analyst reports, market insights, and a vast library of resources to help investors understand REITs better.

Its platform allows access to both REIT ETFs and individual REIT stocks, giving investors flexibility. Fidelity’s low-cost trading model, combined with cutting-edge tools, makes it a go-to option for beginners who want guidance and seasoned investors who value data-driven decisions.

TD Ameritrade

TD Ameritrade, now part of Charles Schwab, remains one of the most advanced trading platforms for REIT investors. Its thinkorswim platform provides technical analysis tools, customizable dashboards, and real-time market data.

This broker appeals to active traders who want to analyze REIT performance alongside other asset classes. With strong research tools and commission-free options, TD Ameritrade gives investors both flexibility and depth in their REIT strategies.

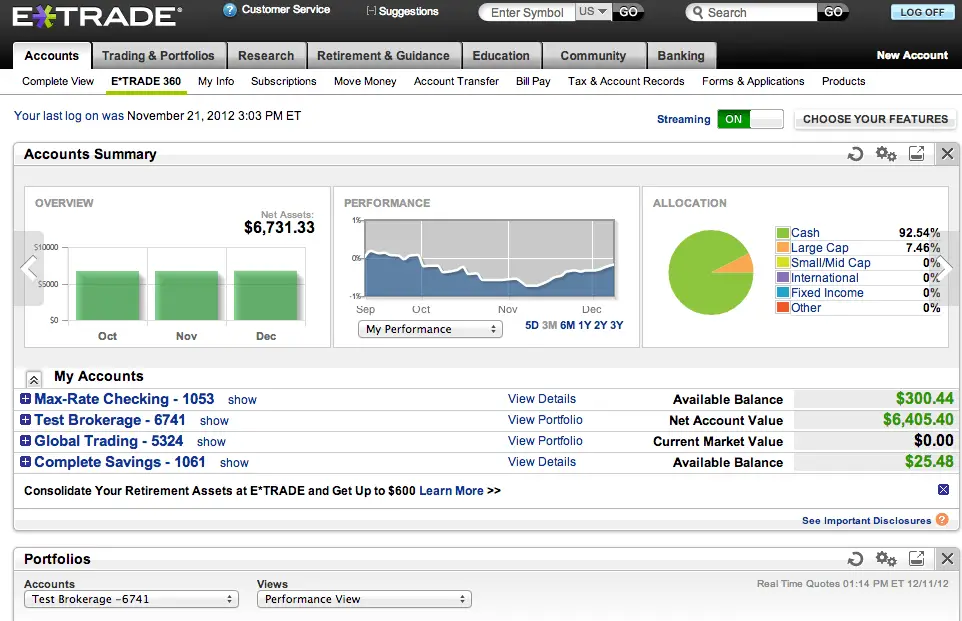

ETRADE

E*TRADE is popular among REIT investors who want a balance of ease and functionality. It offers intuitive platforms, mobile access, and extensive screening tools to filter REITs by sector, dividend yield, or market cap.

E*TRADE also provides managed portfolio options, which are attractive for investors who prefer a hands-off approach while still benefiting from REIT exposure. Its versatility makes it suitable for both passive and active investors.

Interactive Brokers

Interactive Brokers is renowned for catering to advanced investors with global exposure. It provides access to international REITs and ETFs, making it ideal for those who want to diversify across markets.

With some of the lowest transaction costs in the industry and advanced trading tools, Interactive Brokers appeals to professionals and high-net-worth individuals. Its global reach allows investors to explore real estate opportunities beyond domestic markets, which adds a layer of diversification and resilience.

Benefits of Using Technology in REIT Investing

Technology has transformed how investors approach REITs. Brokers now integrate advanced tools into their platforms, offering:

- Automated portfolio management: Robo-advisors allocate REIT investments based on investor goals.

- Real-time updates: Market data, dividend announcements, and sector trends are instantly available.

- Mobile access: Investors can trade REITs anytime, anywhere, improving flexibility.

- Data visualization: Interactive charts and dashboards help investors assess performance clearly.

By leveraging these tools, investors save time, reduce errors, and make more informed decisions. This democratizes access to REIT investing, once considered a domain for institutions and high-net-worth individuals.

Practical Use Cases of REIT Brokers

Generating Passive Income

Many individuals turn to REITs for dividend income. The best brokers make it easy to identify high-yield REITs and automate dividend reinvestments. This allows investors to build wealth passively over time without active management.

Diversifying Portfolios

REITs provide diversification beyond traditional stocks and bonds. Brokers offering sector-specific REITs such as healthcare, retail, or industrial, help investors reduce risk and align with long-term market trends.

Simplifying Global Investing

For investors seeking exposure beyond domestic markets, brokers like Interactive Brokers provide access to international REITs. This allows individuals to invest in properties across multiple countries, spreading risk and enhancing returns.

Supporting Retirement Planning

Many retirement accounts now include REITs as part of their structure. Brokers with strong retirement planning tools enable investors to incorporate REITs into IRAs or 401(k)s, securing steady income during retirement.

Frequently Asked Questions

1. What should I look for in the best REIT brokers?

Look for low fees, strong research tools, accessibility, and a wide range of REIT products. A good broker should align with your investment goals, whether that’s passive income, diversification, or global exposure.

2. Are REITs a safe investment through brokers?

REITs carry risks like any investment, but working with reputable brokers adds a layer of security. The best brokers provide research tools and resources to help investors make informed decisions, reducing potential risks.

3. Can I invest in both domestic and international REITs with brokers?

Yes, many brokers provide access to both domestic and global REITs. Brokers like Interactive Brokers specialize in international markets, while others like Fidelity and Schwab focus heavily on U.S.-based REITs.